Boosting a product or service offering with optimized costs is a strategic objective of most manufacturing and service industries in the world. The ways to achieve this objective can range from shortsighted organizational downsizing and payroll cuts to farsighted plans to combat hidden costs. In the latter tactics, management exerts tight control over cost of quality (COQ) to achieve more with less while balancing the trilogy of profitability, customer satisfaction and employee satisfaction. If inflated, COQ becomes a serious silent killer that eats profitability for breakfast.

Monitoring and controlling COQ is indispensable to survival.

What Is COQ and COPQ?

COQ and cost of poor quality (COPQ) are sometimes erroneously thought to be synonymous, but COPQ is one component of COQ. COQ, sometimes referred to as total COQ, is the sum total of costs associated with preventing failures and appraising quality level and costs resulting from failures. So COQ is made up of two main components:

1. Cost of good quality (COGQ) represented by prevention and appraisal costs, and

2. COPQ for failures costs.

Failure costs are divided into external costs (supply chain costs) and internal costs (field failure costs). Total COQ can be represented in the equation below.

Figure 1: Equation for Total COQ

COQ Components

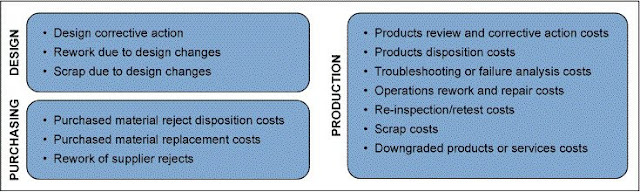

The key differentiator between internal and external failure costs is whether they occur before or after reaching the customer. Internal failures are those resulting from a product or service’s nonconformance to requirements that occurs before reaching the customer – whether those failures take place in any of the design, procurement or production processes. For instance, if a finished product requires rework due to design changes, it takes place before delivery to the customer and is an internal failure. Similarly, replacing defective raw materials acquired from a supplier happens during the procurement process and is considered an internal failure.

Figure 2: Examples of Internal Failure Costs

Conversely, external failure costs are those costs incurred by a product or service’s nonconformance to requirements that occurs after reaching the customer. Toyota’s 2019 recall of vehicles due to unintended acceleration is a poignant example of an external failure, which caused 52 deaths, 38 injuries and a financial loss of $5.5 billion. Another example of an external failure is the tragic 1986 Space Shuttle Challenger explosion that occurred 73 seconds after takeoff, causing seven deaths and a financial loss of more than $1 billion. A more mundane example would be when a customer returns a defective product to the seller for a refund or makes a claim against the manufacturer’s warranty.

Figure 3: Examples of External Failure Costs

On the other end of the spectrum exists the COGQ that, if leveraged, combats poor quality costs. Despite being costs, appraisal and prevention activities are desirable to a certain extent beyond which the law of diminishing returns dominates. Raw materials being inspected (appraisal activity), for instance, will decrease the odds of having nonconforming input to the manufacturing process. Even better, reviewing and rating your suppliers regularly (prevention activity) increases the odds of receiving consistent quality materials which could eliminate the need for frequent inspections down the road.

Although appraisal costs are considered COGQ, they must be used sparingly. This is because they are detective rather than preventive activities. For example, inspection of a finished product at the end of the line would probably detect defects, but will never eliminate the root causes; thus, defects recur. Appraisal costs are costs incurred to determine the degree of conformance to quality requirements – not to prevent causes of failure. This component of the COQ can take place anywhere during procuring raw materials, producing an item, or could be in activities external to the organization such as inspections, tests or audits conducted at the site for installation or delivery.

Figure 4: Examples of Appraisal Costs

Prevention costs are the other part of the COGQ; they are the costs of all activities designed to prevent poor quality in products or services. It is best to maximize the equation as they keep failure and appraisal costs to a minimum. Cost to eliminate a failure after delivery is five times that at the development or manufacturing phase. Prevention activities, therefore, are best performed at upstream rather than downstream processes. For instance, reviewing a design before release to manufacturing would spare the organization extra costs that might be incurred due to internal or external failures after production. Prevention activities might be deployed anywhere in the value stream, from marketing through production.

Figure 5: Examples of Prevention Costs

Optimizing TCOQ

Going back to the total COQ formula mentioned above, logically yet still controversial, the TCOQ value cannot be zero. It is an optimization problem. Since nobody is operating in a perfect world, no organization can ever produce or offer a defect-free product or service without deploying appraisal or prevention measures. Obviously, COGQ components – appraisal and prevention costs – need to be maximized, while COPQ components – internal and external failure costs – are to be minimized to reach to the minimum TCOQ value.

Figure 6: Optimizing COQ

As shown in Figure 6 above, COPQ declines as the quality level improves, but this doesn’t occur without exerting some level of prevention efforts. The key question that the TCOQ formula should answer is: To what extent should the organization invest in COGQ so that it reaches the minimum TCOQ with the optimum quality level of the product or service? The answer points to where the organization needs to position itself consistently to retain competitiveness or, more bluntly, to survive.

Improving a product or service quality level while keeping profitability at decent levels is not a walk in the park endeavor. It means having a proper grasp of the COQ concept and methodology, coupled with a standardized approach of monitoring and controlling over optimum levels of cost. Such mastery will allow the organization to balance the competing demands of profit and customer and employee satisfaction.

0 comments:

Post a Comment